By now, many of our clients’ mailboxes are overflowing with tax slips from various companies. The 2014 tax year is an especially daunting one for our clients: PWL’s transition from TD Waterhouse Institutional Services to National Bank Correspondent Network means clients may receive two T3 or T5 slips (one from each brokerage) for a number of securities, which is sure to add to the complexity.

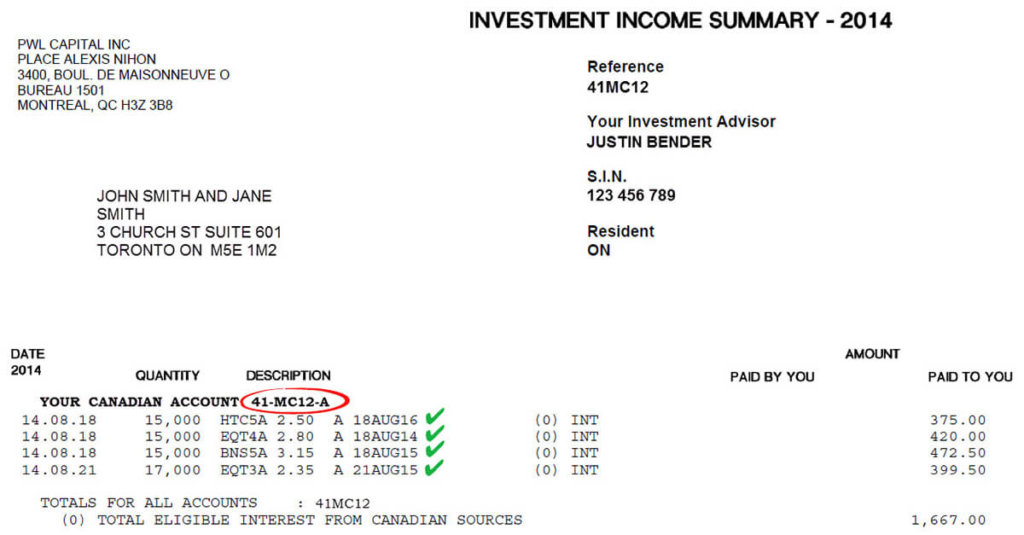

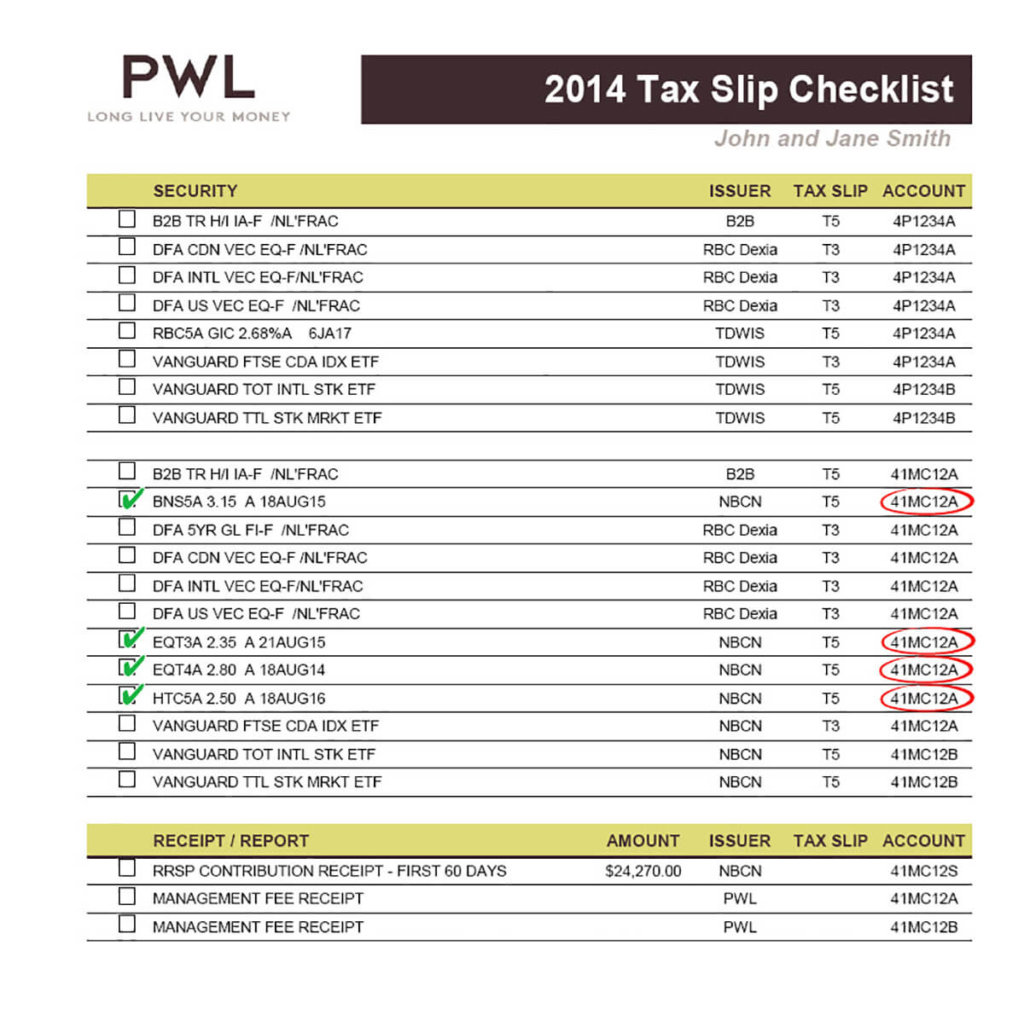

To make things easier, our Toronto team compiles customized tax slip checklists for every client with a taxable personal account: you’ll receive this by email shortly. As you receive your T-slips, simply verify the security name and account number (which you’ll find on the tax slip itself, or on the investment summary) against the information on your PWL 2014 Tax Slip Checklist. Below I’ve included an example of an NBCN Investment Income Summary and how it relates to the checklist.

Some tax slips and reports (such as T3 slips and the Realized Capital Gains & Losses Report) will arrive later in March or early April. If you are still missing any items by the beginning of April, please contact any member of our team so we can retrieve a duplicate slip for you:

Contact Justin Bender

Contact Dan Bortolotti

Contact Amanda Dalziel

Contact Shannon Bender