This blog post is adapted from my French column with the newspaper Les Affaires.

This summer, the first increase in the Bank of Canada’s policy interest rate in seven years has triggered an avalanche of advice in the media. How should you react to the new context? Which investments should you sell? What should you buy? Experts are lining up to tell you what to do. And I’m sure you can’t wait to hear my opinion. What’s the best approach? The first step is understanding what it’s all about.

What is the Bank of Canada’s policy interest rate?

The Bank of Canada’s policy interest rate is a guide for the overnight rate for loans between major financial institutions. The central bank dictates only this rate.

What is the impact on your investments?

The Bank of Canada influences — but doesn’t set — longer-term bond yields, say for one to 30 years. Other factors have an impact on bond yields, including the behaviour of U.S. interest rates, inflation, economic and employment growth in Canada and the global economic context.

More often than not, a sudden, sharp hike in the policy interest rate is accompanied by a dip in bond values. This time, however, futures markets anticipate a very gradual rise, spread over several years. We’re looking at 1% between now and 2019. Nothing to write home about.

Besides, the market has already taken the expected rate hikes into account in bond and equity prices. That means there’ll be NO impact on your portfolio’s performance going forward. The only way that future rate hikes can affect the future returns on your investments is if they differ substantially from what’s expected.

How to adapt your portfolio to the upcoming increase

If you think the best thing to do is to position your portfolio strategically so as to benefit from the policy interest rate increase, think again! Keep in mind that in order to take advantage of a rate hike, you have to be better at predicting future changes in the rate than the hundreds of professional traders who determine bond and equity prices. You’re thus up against the top experts, many of whom put their jobs on the line each day to make money in the market and earn a living.

A bit of advice, anyway

In short, only the unanticipated portion of future rate hikes will have an impact on your portfolio. And foreseeing unanticipated hikes means predicting the unpredictable, which is absurd. Nonetheless, for those of you who haven’t already stopped reading this blog post, I have a tip.

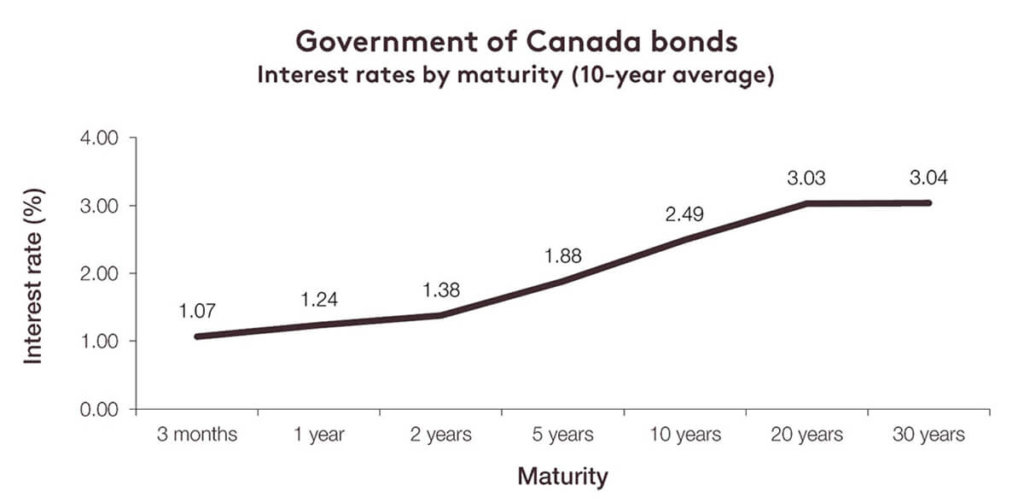

Most of the time (let’s say 90%, and that’s a conservative figure), long-term interest rates are higher than short-term rates. In practical terms, over a long period, ten-year rates are higher than three-month rates by an average of over 1%. It’s called the maturity premium. That’s why, in my June blog post*, I suggested BMO Aggregate Bond Index ETF (ticker: ZAG) and equivalent products offered by other index exchange traded fund (ETF) providers, such as Vanguard Canadian Aggregate Bond Index ETF (ticker: VAB) and iShares Core Canadian Universe Bond Index ETF (ticker: XBB). As all of these ETFs feature an average maturity of about 10 years, high-quality securities and minimal management fees, you should keep them in mind for the bond portion of your RRSP. While it’s true that these ETFs are more volatile than short-term investments, investors are well compensated (via the maturity premium) for bearing the risk, provided they keep their ETFs for the long run. And the fact that about 10% of your portfolio is renewed each year as investments mature means that you benefit from future rate hikes as your money is reinvested.

Sources: Bloomberg, PWL Capital

—–

* “An ETF portfolio resistant to real estate market crashes and other calamities”, PWL Capital, June 2017