Yes, they did! In 2018, passively managed index funds once again increased their market share in the United States, rising from 35% to 37%, according to Morningstar. So, is this good or bad? Should you follow the trend? Everyone is doing it, why not you? Just because indexing is popular doesn’t mean it’s the best solution for you. Despite the arguments in its favor, indexing is the subject of many criticisms. Here are a few.

1. Index funds increase market volatility

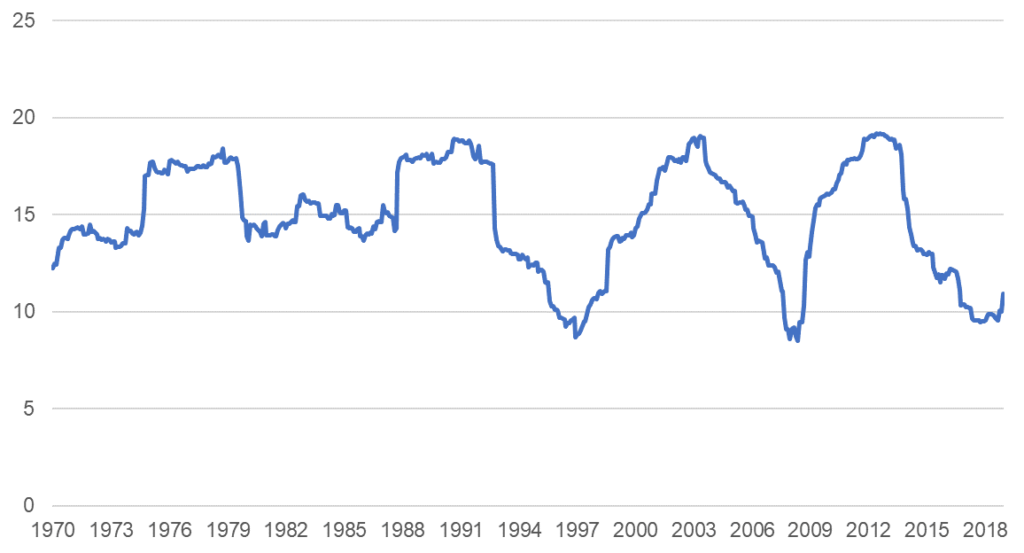

Nowhere else is indexing more popular than in the U.S. The graph below shows that the volatility of the S&P 500, the flagship index of U.S. shares, has stayed within a range of 10% to 20% since 1970. The arrival of index funds in 1975 and the growth of their market share since 2000 have not changed this trend in the least. Volatility has even remained in the bottom of the range for several years.

Graph 1: Volatility of the U.S. stock market over 60 months, 1970-2018

Source: Morningstar

2. Index funds make companies less competitive

Some critics argue that the growing popularity of index funds is resulting in a concentration of publicly traded shares being held by a handful of management firms: primarily Blackrock/iShares and Vanguard. The fact that these managers hold significant positions in virtually all public companies could incite them to discourage companies from aggressively competing with each other to increase their profit margins at the expense of consumers (when there is less competition, product prices are higher).

For a long time, we have lived in a world where share ownership is highly fragmented, meaning that most companies are controlled by a highly diversified group of investors and do not have shareholders representing more than 5% or 10% of their capital. This is too bad, but votes at shareholder meetings are often symbolic as shareholders rarely have the means to dismiss boards of directors, let alone management teams. On the other hand, executives of most public companies receive a large portion of their compensation in the form of stock options, encouraging them to do everything in their power to maximize their share price. The best way to maximize their wealth is to launch better products at better prices and claim market shares at the expense of their competitors. You can therefore be assured that indexing does not harm consumers.

3. Index funds make markets less efficient

The efficient market hypothesis states that share prices reflect all publicly available information at all times. Only future information — and therefore unknown at this moment in time — will have an impact on price movements. If markets were not efficient, it would be relatively easy to beat market indices, since the most skilled investors could regularly predict which shares will be good or bad ones in the coming year.

According to studies published by Standard & Poor’s1— which I quote frequently — the vast majority of fund managers fail to outperform their benchmark over long periods of time, whether they are in Canada, the United States, Europe, the United Kingdom, Japan or Australia.

Don’t get me wrong. Standard & Poor’s is quite happy to provide proof of the superiority of indexing, as the index funds that track the S&P indexes must pay it significant royalties. These studies are therefore not unbiased. But they have been published twice yearly for 20 years, and I have yet to see any serious rebuffing. I conclude that they are probably accurate and that the efficient market hypothesis works quite well, thank you.

4. Market value weighted index funds overinvest in overvalued shares and therefore inevitably generate poor returns

Some fund dealers argue that since overvalued shares trade at a higher price than their true value, they are inevitably overweighted by indices. The most famous promoter of this idea is Robert Arnott, founder of the investment management firm Research Affiliates. The argument makes sense at first glance, but it changes nothing about the index fund’s performance. Here’s a simplified example.

During a cruise in the Pacific, you get shipwrecked on Active Managers Island on January 1st. On this island, there are only two companies: Loblaw’s and IGA. The day you arrive on the island, each company launches its initial public offering for one million shares at $10. You decide to start an index fund. This means you will have to buy an equal number of each of the two shares: let’s say one thousand each. No matter what happens to the share price, you will continue to hold an equal number of shares of each, reflecting market floats.

Suppose a speculative fever breaks out over IGA shares, and during this time, Loblaw’s shares are neglected by the island dwellers. IGA shares become overvalued and rise to $15, while Loblaw’s shares become undervalued and fall to $5. Toward the end of the year, the sorcerer of the tribe of active managers has a dream that reveals that the true value of each of the shares is $11. He tells the islanders the news. The price of the two shares closes the year at this price. Table 1 below summarizes the value of the index portfolio at various points during the year.

Table 1: Value of the index portfolio (hypothetical example for illustrative purposes)

| Date |

Number of IGA shares |

Price per IGA share |

Number of Loblaw’s shares |

Price per Loblaw’s share |

Total value of index portfolio |

| January 1st |

1,000 |

$10.00 |

1,000 |

$10.00 |

$2,000 |

| June 30 |

1,000 |

$15.00 |

1,000 |

$5.00 |

$2,000 |

| December 31 |

1,000 |

$11.00 |

1,000 |

$11.00 |

$2,200 |

| Return on the index portfolio at year end = |

| $2,200 – $2,000 |

=10% |

| $2,000 |

|

Your index portfolio finishes the year with a return of 10% (a profit of $200 on an investment of $2,000), despite the fact that IGA had represented at its peak 75% of its value. In addition, you would have obtained the exact same result if you had started your index fund when IGA was at its peak and Loblaw’s at its low (on June 30). Ultimately, the overvaluation of expensive shares is offset by the undervaluation of cheap shares.

A final note

Index funds are not perfect, and obviously you should not invest in just any of them. You may feel more comfortable with funds that rely on traditional active management, and that’s perfectly legitimate. As for me, in addition to the plethora of facts arguing in favour of quality index funds, I am comforted by the weaknesses of their critics’ claims.

——————