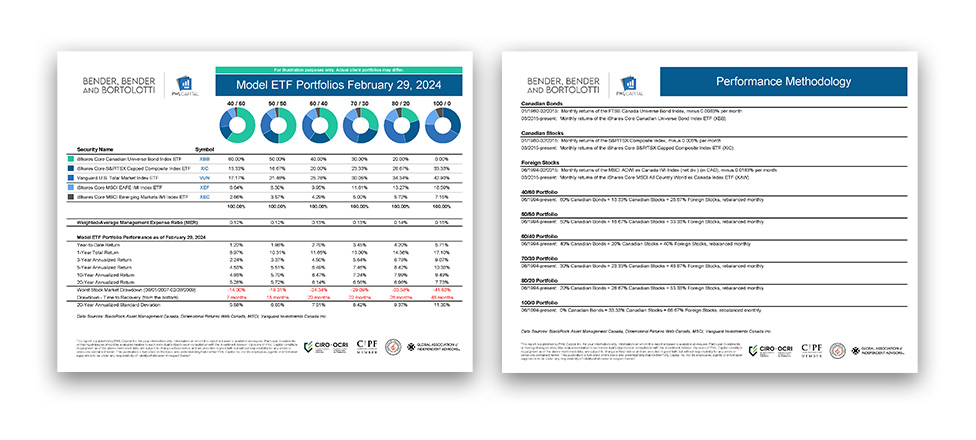

This document provides the performance data for the Model ETF Portfolios as of February 2024, as compiled by the team.

For illustration purposes only. Actual client portfolios may be different.

The PWL Model Portfolios have relatively short track records. However, they often track indexes with a longer history, so whenever fund returns were not available, we used the underlying index returns and subtracted the current management expense ratio of the fund. In a number of cases, we have had to approximate the returns of the asset classes using other indexes. All returns are in Canadian dollars and the portfolios are rebalanced annually.

Past performance does not guarantee future results. The historical performance of indexes is illustrative only and is not necessarily a reflection of the future performance of any fund tracking that benchmark.