No one likes losing money on an investment. But sometimes realizing capital losses can enhance your bottom line by reducing your tax bill while you patiently wait for markets to recover.

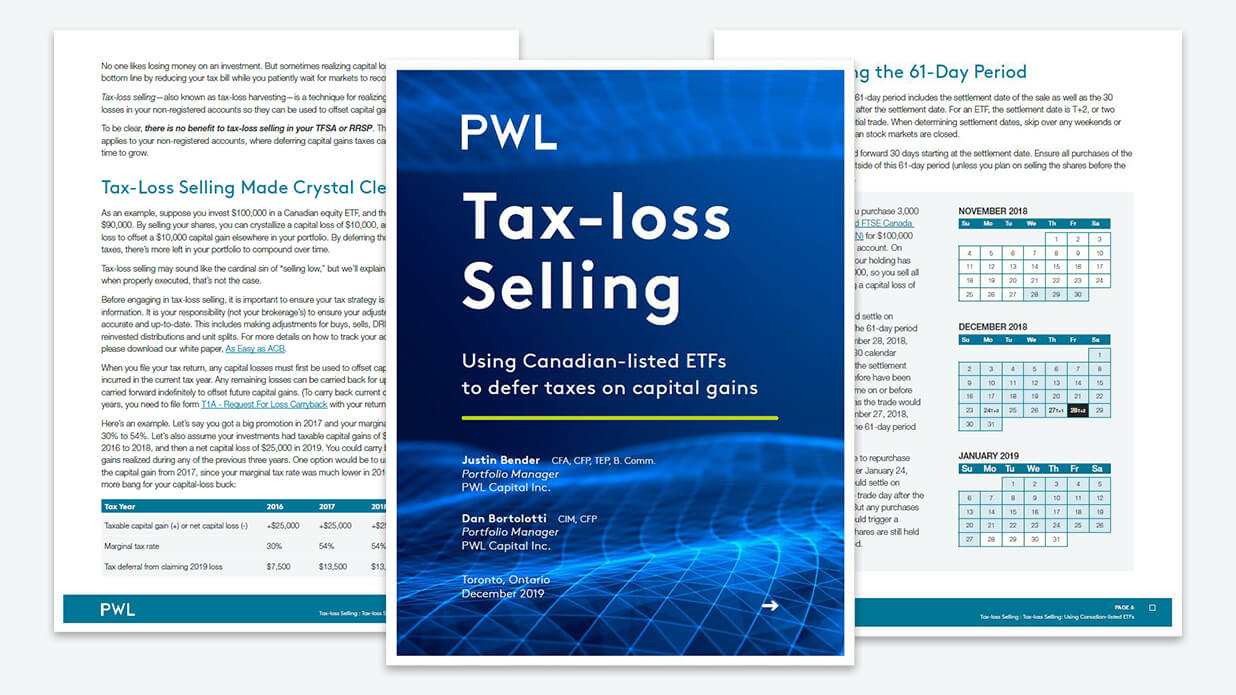

Tax-loss selling—also known as tax-loss harvesting—is a technique for realizing, or crystallizing, capital losses in your non-registered accounts so they can be used to offset capital gains.

To be clear, there is no benefit to tax-loss selling in your TFSA or RRSP. This entire discussion only applies to your non-registered accounts, where deferring capital gains taxes can give your money more time to grow.

This report was written by Justin Bender and Dan Bortolotti, PWL Capital Inc. The ideas, opinions, and recommendations contained in this document are those of the authors and do not necessarily represent the views of PWL Capital Inc.