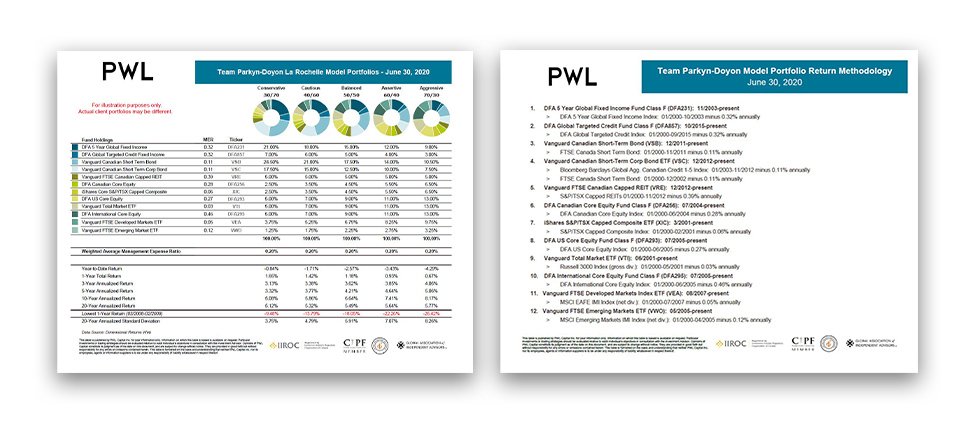

This document provides the performance data for Model Portfolios for June 2020, as compiled by Parkyn-Doyon La Rochelle.

For illustration purposes only. Actual client portfolios may be different.

Source : Dimensional Returns Web

This table is published by PWL Capital Inc. for your information only. Information on which this table is based is available on request. Particular investments or trading strategies should be evaluated relative to each individual’s objectives in consultation with the Investment Advisor. Opinions of PWL Capital constitute its judgment as of the date on this document, and are subject to change without notice. They are provided in good faith but without responsibility for any errors or omissions contained herein. This table is furnished on the basis and understanding that neither PWL Capital Inc. nor its employees, agents or information suppliers is to be under any responsibility of liability whatsoever in respect thereof.