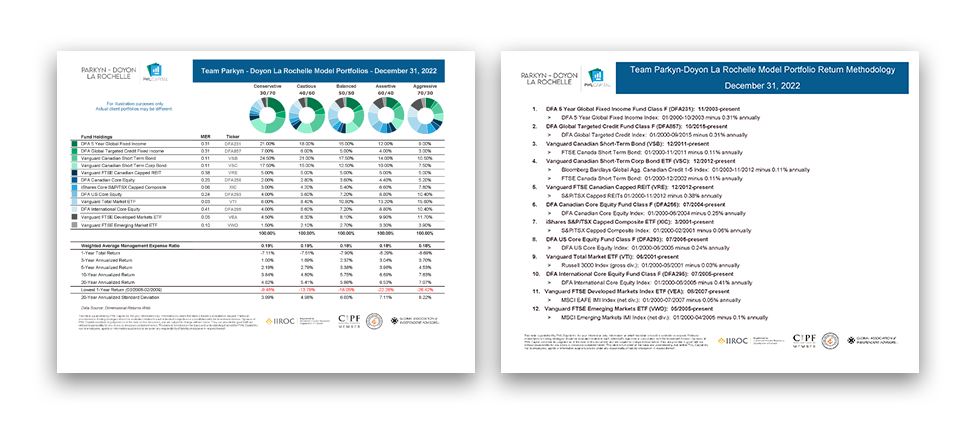

This document provides the performance data for Dimensional Global Portfolios for December 31, as compiled by the Parkyn-Doyon La Rochelle.

For illustration purposes only. Actual client portfolios may be different.

The Dimensional Global Portfolios have relatively short track records in Canada. However, these funds follow rules-based indexes which have longer histories. Where fund return data is not available, we have used index data adjusted for the current management expense ratio of the applicable fund. All returns are in Canadian dollars. The index returns consist of the average return of four quarterly staggered indexes which are reconstituted annually, while the portfolios are rebalanced on a continuous basis. The index returns include the profitability filter since inception, while the portfolios were in transition to applying the profitability filter in 2014. Index returns do not reflect the momentum screen that is used in live trading for the portfolios.

Past performance does not guarantee future results. The historical performance of indexes is illustrative only and is not necessarily a reflection of the future performance of any fund tracking that benchmark.