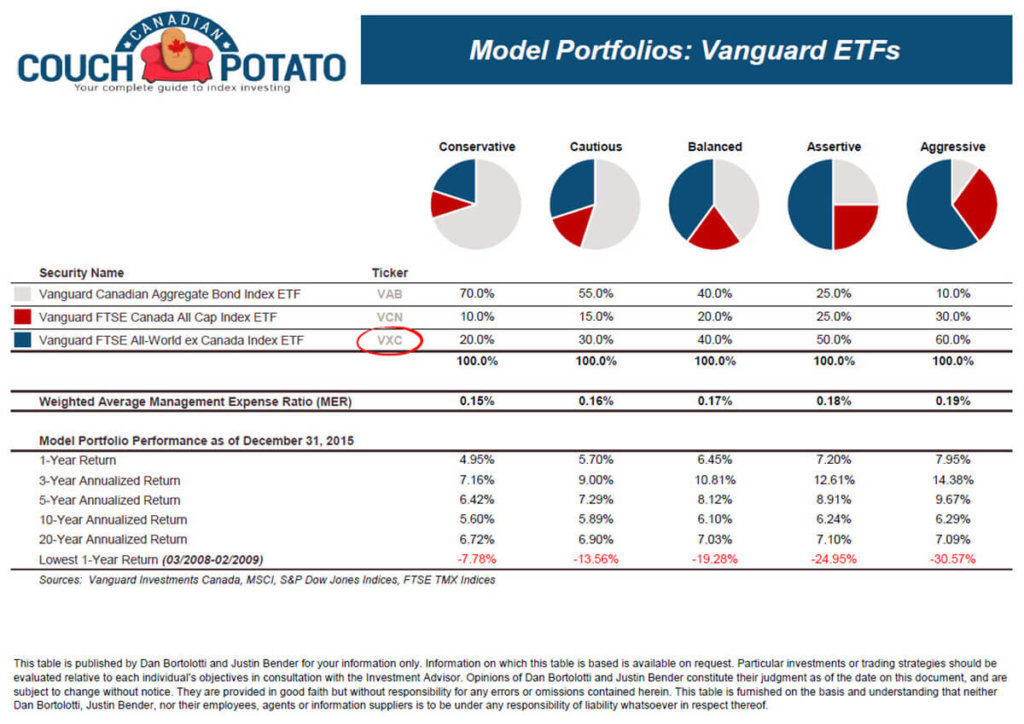

The Couch Potato portfolio has it all – low fees, broad-diversification, and simplicity. There’s not a whole lot of room for improvement, but with a few tweaks, investors can lower their costs even further.

One such improvement can help mitigate the drag from foreign withholding taxes levied on dividends paid from US and other international companies. If we look at the Couch Potato model ETF portfolios, we find that they hold just a single foreign equity fund, the Vanguard FTSE Global All Cap ex Canada Index ETF (VXC). Pretty simple, right?

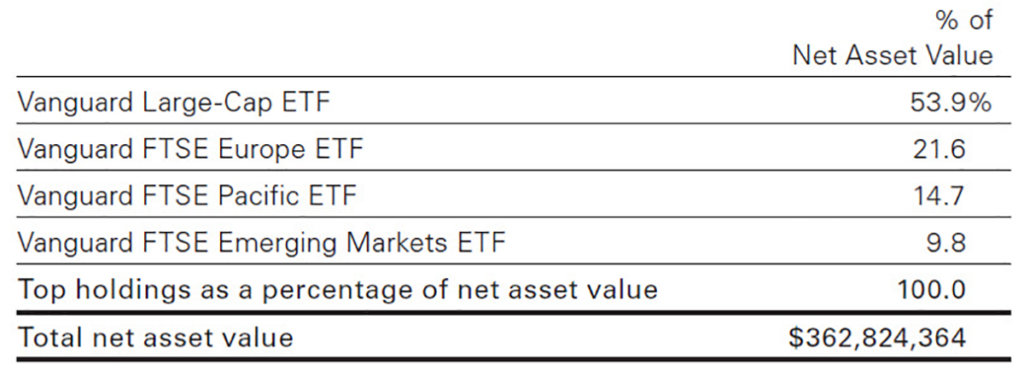

If we pop the hood of VXC, we find that it holds four US-listed ETFs, which together hold over 7,500 stocks from across the globe. This “wrap” structure is not such a big issue in a taxable account, but the additional costs become more apparent when the fund is held in an RRSP account (which is discussed in more detail throughout our Foreign Withholding Taxes white paper).

Underlying Holdings of the Vanguard FTSE Global All Cap ex Canada Index ETF (VXC)

Source: Source: Vanguard Canada Quarterly Portfolio Disclosure as of March 31, 2016

Small potatoes?

Although VXC’s wrap structure may not seem important at first, holding the underlying US-listed ETFs directly in your RRSP would be much more tax-efficient.

To help illustrate this concept, I’ve estimated the total cost of holding VXC (0.71%) versus holding the underlying US-listed ETFs directly (0.19%). By holding the US-listed ETFs directly, an additional cost savings of 0.52% per year can be expected (this estimate includes the lower expense ratios of the US-listed ETFs, as well as the lower foreign withholding taxes levied – however, it does not include the costs of currency conversion, which can be substantial if not carefully implemented).

For more information on how not to get hosed by the big banks on currency conversions, please read about the Norbert’s gambit strategy.

Estimated expense reduction of using US-listed ETFs in your RRSP

| VANGUARD FTSE GLOBAL ALL CAP EX CANADA INDEX ETF (VXC) |

ALLOCATION (%) |

MER (%) |

ESTIMATED FWT |

TOTAL COST |

| Vanguard US Large-Cap ETF (VV) |

54.76% |

0.27% |

0.30% |

0.57% |

| Vanguard FTSE Europe ETF (VGK) |

21.98% |

0.27% |

0.65% |

0.92% |

| Vanguard FTSE Pacific ETF (VPL) |

14.23% |

0.27% |

0.51% |

0.78% |

| Vanguard FTSE Emerging Markets ETF (VWO) |

9.03% |

0.27% |

0.69% |

0.96% |

| WEIGHTED AVERAGE COST |

100% |

0.27% |

0.44% |

0.71% |

| UNDERLYING US-LISTED ETFS |

|

|

|

|

| Vanguard US Large-Cap ETF (VV) |

54.76% |

0.08% |

0.00% |

0.08% |

| Vanguard FTSE Europe ETF (VGK) |

21.98% |

0.12% |

0.17% |

0.29% |

| Vanguard FTSE Pacific ETF (VPL) |

14.23% |

0.12% |

0.15% |

0.27% |

| Vanguard FTSE Emerging Markets ETF (VWO) |

9.03% |

0.15% |

0.29% |

0.44% |

| WEIGHTED AVERAGE COST |

100% |

0.10% |

0.09% |

0.19% |

| DIFFERENCE |

|

0.17% |

0.35% |

0.52% |

Sources: BlackRock Canada, MSCI Index Fact Sheets as of May 31, 2016

Although holding US-listed ETFs in your RRSP is not absolutely necessary for couch potato investors, it can lead to substantial cost savings over time. These benefits should first be weighed against other factors (i.e. lack of simplicity, additional trading costs, US estate taxes, etc.) before making a final decision on the appropriate plan of action.