Ce document fournit les données de performance des portefeuilles modèles de février 2023, telles que compilées par l’équipe Parkyn-Doyon La Rochelle.

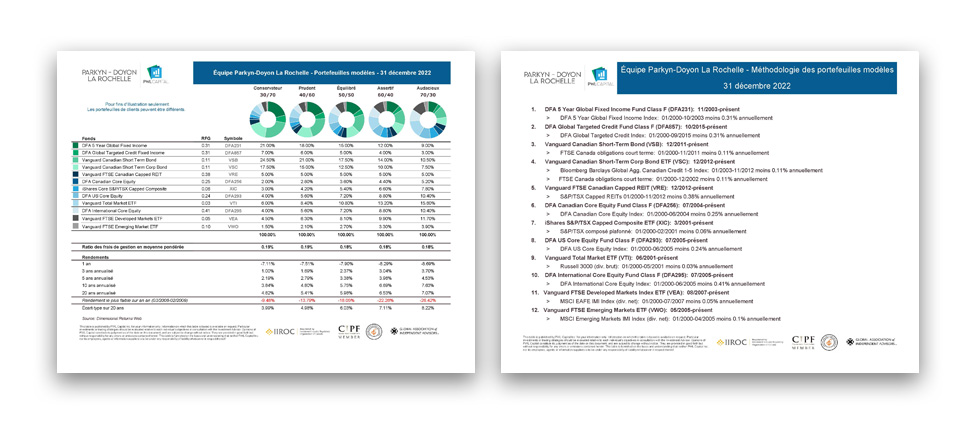

Pour fins d’illustration seulement. Les portefeuilles de clients peuvent être différents.

Source : Dimensional Returns Web