Q: “Why do some people still use XEF/XEC vs. VIU/VEE, since both VIU and VEE are more diversified?”

As new ETFs are released, it’s natural for index investors to succumb to what I like to call “ETF envy”. I often witness it when an ETF provider lowers their fees below that of their competitors’ – this is usually met with investor excitement as they frantically switch their higher-cost fund to the lower-cost alternative. As one would expect, the higher-cost provider usually follows suit by lowering their fee to match.

This can be detrimental to an investor’s financial health if it causes them to realize unnecessary trading costs, bid-ask spreads and capital gains in pursuit of a temporarily superior product.

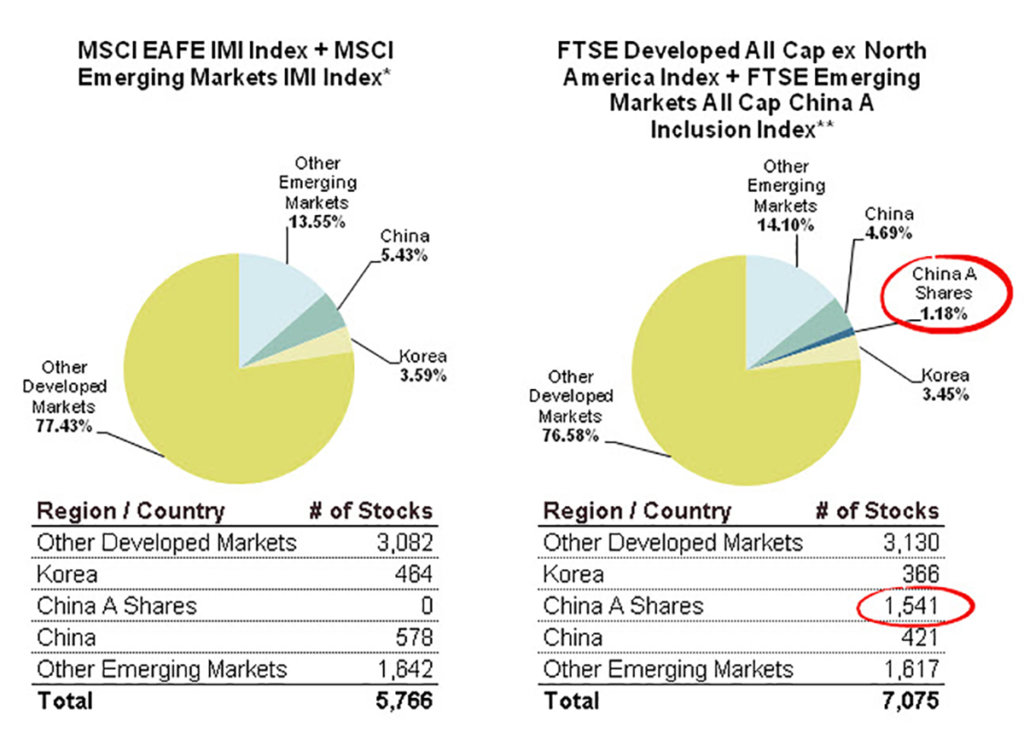

Hard-core index investors also tend to exhibit this behavior while in search of the most diversified ETF. If we base our decision simply on the number of underlying index holdings that an ETF tracks, Vanguard would beat iShares hands down (7,075 stocks vs. 5,766 stocks). However, it is important to dig a little deeper with our analysis to ensure we have not missed any subtleties that may impact our decision.

iShares ETFs

| SECURITY |

MER |

UNDERLYING INDEX |

NUMBER OF STOCKS

IN THE INDEX |

| iShares Core MSCI EAFE IMI Index ETF (XEF) |

0.22% |

MSCI EAFE IMI Index |

3,082 |

| iShares Core MSCI Emerging Markets IMI Index (XEC) |

0.26% |

MSCI Emerging Markets IMI Index |

2,684 |

| Total |

|

|

5,766 |

Sources: BlackRock Canada, MSCI Index Fact Sheets as of May 31, 2016

Vanguard ETFs

| SECURITY |

MER |

UNDERLYING INDEX |

NUMBER OF STOCKS

IN THE INDEX |

| Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) |

0.22% |

FTSE Developed All Cap ex North America Index |

3,496 |

| Vanguard FTSE Emerging Markets All Cap Index ETF (VEE) |

0.24% |

FTSE Emerging Markets All Cap China A Inclusion Index |

3,579 |

| Total |

|

|

7,075 |

Sources: BlackRock Canada, MSCI Index Fact Sheets as of May 31, 2016

The inclusion of China A shares in FTSE indices

In May 2015, FTSE released several new emerging markets indices, which included a modest allocation to China A shares (about 5%). In November 2015, Vanguard began transitioning to these new indices, which currently include an additional 1,541 China A shares.

Although this may sound impressive, the 1,541 additional China A shares account for only 1.18% of the total developed/emerging markets allocation. To put this into perspective, for a balanced Couch Potato portfolio that allocates 20% to VIU/VEE, only 0.24% of your entire portfolio will hold the additional China A shares.

Sources: MSCI and FTSE Index Fact Sheets as of May 31, 2016 *77.43% MSCI EAFE IMI Index + 22.57% MSCI Emerging Markets IMI Index **80.03% FTSE Developed All Cap ex North America Index + 19.97% FTSE Emerging Markets All Cap China A Inclusion Index

MSCI on a slow boat to China

Although MSCI has not yet added China A shares to their indices, it is only a matter of time until they do (MSCI will be announcing their next China A share inclusion decision on June 14, 2016). MSCI has proposed an initial 5% partial inclusion of China A shares (or about 1.1% of their emerging markets index). If they move ahead with this proposal, it will take effect in June 2017. The initial allocation will be less than the amount FTSE started out with, but will likely include a larger number of stocks (which may in turn make XEF/XEC look more diversified than VIU/VEE).

In the end, there is no right or wrong decision. Both pairs of ETFs will provide adequate diversification for investors. MSCI and FTSE will eventually have a similar allocation to China A shares in their emerging markets indices, so any significant differences in weights or stock holdings is expected to be temporary.